The Market Knows Best: Using Data From Prediction Markets to Assess National Security Threats

Introduction

Prediction markets, also known as information markets or event futures, are being used to forecast events as diverse as sporting outcomes, election results, macroeconomic forecasts, and geopolitical events.1 By aggregating diverse opinions and incentivizing prediction accuracy with financial gain through successful trading, these markets demonstrate remarkable usefulness and accuracy. The data generated by contract trading in prediction markets can serve as a new source of information for intelligence analysts to identify and assess national security threats. Platforms like Polymarket and Kalshi,2 which allow trading on a wide range of event-based contracts, provide an opportunity for intelligence professionals to collect a novel type of data to identify new threats and assess the changing nature of existing national security risks.

In this article, we begin by explaining the nature of a prediction market and how it operates. We then discuss the information that intelligence analysts can extract from contract trading in these markets, as well as the types of contracts that analysts will find most useful. We’ll review the techniques intelligence analysts can apply to this data to enhance the quality of their analyses, then move on to a discussion of how prediction market data can be integrated with traditional sources of military intelligence, with a specific focus on all-source analysis. Finally, we’ll conclude with commentary on how prediction markets might evolve in the future and their increasing relevance to intelligence professionals.

Understanding Prediction Markets

Prediction markets operate on the principle that collective intelligence, when combined with financial incentives, can yield highly accurate forecasts.3 Participants buy and sell contracts based on their expectations of future events. The mechanics of these markets are designed to ensure efficiency and accuracy. Each contract represents a binary outcome—the event either occurs or it doesn’t. When the event occurs, the contract pays $1; if it doesn’t occur, the contract pays nothing. This simple pay-off scheme creates a direct relationship between contract prices and probability estimates. For example, a contract trading at $0.45 suggests the market estimates a 45 percent chance of the event occurring.

Polymarket, the world’s largest prediction market platform, offers investors a wide array of contracts to trade covering issues such as elections, economic indicators, and geopolitical developments. The data generated through trading provides valuable insights into the collective expectations of informed individuals. This effect is comparable to the “wisdom of crowds” as described by James Surowiecki in his 2004 book of the same title.4

What makes prediction markets especially informative is their self-correcting nature. If participants believe a contract is mispriced relative to the true probability of an event, they have a financial incentive to trade and move the price toward what they believe is the correct probability. This process, known as price discovery, helps ensure that contract prices reflect the most current information available about an event.5

The liquidity and trading volume of contracts in a prediction market also provide important signals.6 Higher trading volumes typically indicate greater certainty or interest in an outcome, while lower volumes might suggest uncertainty or a lack of investor concern about the event. Market participants provide initial liquidity for each contract and help to establish baseline probabilities of the event’s occurrence. These probabilities change over time as new information is revealed; traders react to these changes by buying and selling the specific event’s contract.

Usefulness of Contract Trading Data

Prediction markets function on data that intelligence professionals do not commonly collect or analyze. Unlike traditional intelligence sources, which often rely on classified information, technical surveillance, or field reports, prediction markets aggregate insights from both the public and private sectors, drawing on multiple participants. These participants include subject matter experts, analysts, and informed individuals who may possess unique perspectives or early indicators of emerging threats.

What makes prediction market data especially distinctive is its dynamic, real-time nature. As new information becomes available or sentiments shift, contract prices adjust. Because this information directly affects potential profit, these price changes occur almost instantaneously. This immediate response contrasts with the slower, often bureaucratic processes of traditional intelligence collection.

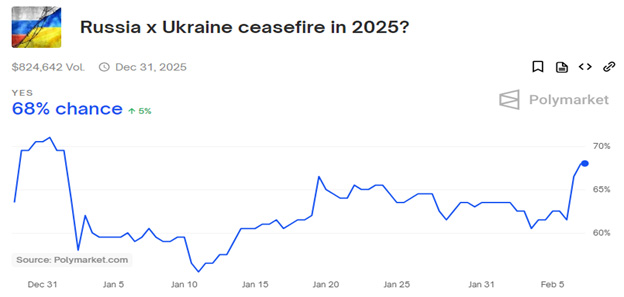

For example, Figure 1 illustrates the time series of an event contract offered by Polymarket. The contract concerns the likelihood of a ceasefire between Russia and Ukraine in 2025. Probability varies as new information becomes available, causing the contract price to respond accordingly. For instance, we observe a high likelihood of a ceasefire in December 2024, followed by a decline in early January 2025. From mid-January through early February, the possibility of a ceasefire gradually increases, approaching its previous high. This behavior is consistent with the efficient market hypothesis developed by economist Eugene Fama in 1970 to explain how prices in financial markets change in response to the arrival of new information.7 The changing likelihood of an event, as reflected in market trends, can be beneficial to intelligence analysts in assessing the risk associated with a specific threat.

Figure 1. Contract price trend as a predictor of a Russia x Ukraine ceasefire by Polymarket, February 2025

The price of a contract in a prediction market reflects the synthesized expectations of market participants. It provides a probabilistic assessment based on a consensus of the contract investors’ beliefs. This data can offer intelligence analysts new perspectives, enabling them to detect early warning signals, confirm other intelligence sources, or uncover trends that might otherwise be overlooked. By integrating this new data, intelligence analysts can exploit the collective foresight and knowledge embedded in event contract prices to more fully anticipate national security threats.

Contracts Most Useful for Intelligence Assessment

Within the broad spectrum of prediction market contracts, certain types of contracts are particularly valuable for military intelligence.8 These contracts provide targeted insights into specific national security concerns, offering actionable intelligence that can improve threat identification and inform strategic response.

Contracts predicting the likelihood of military conflicts between nations or within regions are of critical importance. For example, contracts focused on potential escalations in regions such as the Korean Peninsula, the South China Sea, or Eastern Europe can provide early indicators of rising tensions. Monitoring these contracts can help intelligence analysts anticipate conflicts that may require U.S. military intervention or impact global stability.

Contracts that predict changes in political leadership, such as elections, coups, or resignations, are crucial for understanding potential shifts in national policies or alliances. A contract forecasting the likelihood of a regime change in a Middle Eastern country, for instance, can signal impending shifts in diplomatic relations, security agreements, or regional power dynamics.

Prediction markets often feature contracts related to the imposition or lifting of economic sanctions and trade restrictions. These contracts can assess the likelihood of economic sanctions on an adversarial country or how such activities might influence their foreign policy or military actions. For example, contracts predicting sanctions on Iran’s oil exports can provide insights into potential retaliatory actions taken by the Iranian government.

While specific terrorist attacks are difficult to predict, contracts that gauge the overall activity levels of terrorist organizations or insurgent groups can be informative. Contracts predicting the frequency of attacks in specific regions or the operational capacity of groups like ISIS or Al-Qaeda can help intelligence analysts allocate resources and anticipate threats. Contracts predicting major cyberspace attacks on government institutions, critical infrastructure, or multinational corporations offer valuable insights into emerging cybersecurity threats. For example, a contract forecasting a significant breach of a U.S. government agency can alert intelligence analysts to potential vulnerabilities or adversary capabilities in the cyberspace domain.

Although natural disasters are not typically considered security threats, their aftermath can create conditions that are ripe for instability. Contracts predicting the likelihood of natural disasters or humanitarian crises in politically sensitive regions can help intelligence analysts prepare for secondary security challenges, such as mass migrations, resource conflicts, or opportunistic actions by hostile states or organizations.

The COVID-19 pandemic (March 2020–May 2023) demonstrated the impact that public health crises can have on national security. Contracts that predict the outbreak or spread of infectious diseases, particularly in regions with weak healthcare infrastructures, can help identify potential security challenges related to civil unrest, economic disruption, or strained international relations.

In Figure 2, we provide a small sample of contracts focused on geopolitical risk that were trading on Polymarket in early February 2025. We immediately noted the variety of contracts available for trade. The events varied across the globe and were of a military, political, or diplomatic nature. For some events, such as the Russian recapture of Sudzha, there were multiple contracts based not on whether the event would occur, but on the date by which the event would occur. Furthermore, some markets, for instance Kalshi, invite proposals for new contracts on events that have not been previously introduced.9

|

Contract Event |

Dollar Trading Volume |

Probability of Event Occuring Based on Market Trading |

|---|---|---|

|

Will China invade Taiwan in 2025? |

$1,102,655 |

13% |

|

Nuclear Weapon Detonation in 2025. |

$223,013 |

19% |

|

Khamenei out as Supreme Leader of Iran by June 30. |

$237,929 |

22% |

|

NATO/EU troops fighting in Ukraine in 2025. |

$8,571 |

12% |

|

Will Russia recapture Sudzha by February 2? |

$42,629 |

2% |

|

Will Russia recapture Sudzha by April 30? |

$20,400 |

25% |

|

Will Russia recapture Sudzha by June 30? |

$1,909 |

59% |

Figure 2. Select contracts trading on Polymarket, February 2025 (figure adapted from authors’ original)

Using Data from Contract Trading

Intelligence professionals can utilize information from prediction markets to refine their threat assessments by applying various analytical techniques to the data. Trend analysis can track changes in the probability of an event over time. For instance, if contracts predicting a military conflict in the South China Sea show a steady increase in likelihood, this trend may indicate escalating tensions that are not yet apparent in traditional intelligence. By monitoring these shifts, analysts can identify emerging threats earlier and redistribute surveillance resources more effectively.

Cross-market comparisons are particularly useful when analyzing interconnected events. For example, if prediction market contracts indicate a rising likelihood of economic sanctions against a country but a stable or declining probability of that country responding with military action, intelligence analysts might conclude that economic retaliation is more probable than military action. This comparative analysis of related contracts provides a broader strategic context for any single event.

Anomaly detection involves identifying sudden or unexpected changes in market behavior. A sharp increase in the probability of a terrorist attack in a specific region, for example, might suggest that market participants have gained new information about the likelihood of this event. This price data may then prompt a request for further verification through more traditional intelligence channels, such as signals intelligence (SIGINT) or human intelligence (HUMINT).10

Sentiment analysis evaluates the confidence and consensus among market participants. A high volume of trading with consistent probability levels might indicate a strong consensus regarding an event’s likelihood. Volatile trading patterns, however, might imply uncertainty or conflicting information. These probabilistic assessments complement traditional intelligence analysis by identifying risks where consensus is strong or additional collection is necessary.11

Integrating Prediction Market Data with Traditional Military Intelligence

Prediction market data, while valuable on its own, becomes significantly more useful when integrated with traditional intelligence sources.12 By combining this data with that obtained from other channels, analysts can develop a more comprehensive threat assessment.

HUMINT, which involves gathering information from human sources such as informants, defectors, and local populations, can be enriched by prediction market data. For instance, if prediction contracts suggest an increasing probability of a coup in a particular country, HUMINT resources can be directed to verify this by interacting with local contacts and generating field reports. Conversely, insights from HUMINT can validate or challenge conclusions drawn from the price behavior of event contracts. This creates a feedback loop that enhances the usefulness of both sources.

SIGINT involves intercepting communications and electronic signals to gather intelligence. Contract prices in prediction market trends can guide SIGINT efforts by highlighting areas of increased risk or emerging threats. For example, if a contract’s price implies a high likelihood of a cyberattack on critical infrastructure, SIGINT operations can prioritize scanning for corroborating evidence.

Open-source intelligence (OSINT) involves analyzing publicly available information from media, social networks, and other open sources. Contract price data can help evaluate and contextualize OSINT efforts. If contract data indicates escalating tensions in a region, OSINT analysts can focus on tracking news reports, social media activity, and public statements from key figures to gather continuing intelligence.

Geospatial intelligence (GEOINT) uses satellite imagery, maps, and geospatial data to analyze physical environments. Contract data from prediction markets that signal an increasing likelihood of potential military movements or conflicts can prompt targeted focusing of satellite imagery to detect pending military action. Conversely, unexpected observations in GEOINT data can trigger a review of price movement in related contracts to confirm any initial assessments.

Measurement and signature intelligence (MASINT) focuses on detecting and measuring physical phenomena, such as radiation, chemical signatures, or acoustic signals. Event contracts that forecast specific threats, such as the use of chemical weapons, can guide MASINT efforts to monitor for relevant signatures. In turn, MASINT data can validate or contradict the expectations implied by contract prices, thus enhancing the analyst’s overall situational awareness.

Integrating with All-Source Analysis

All-source intelligence analysis integrates data from multiple collection disciplines, including HUMINT, SIGINT, OSINT, GEOINT, and MASINT, to develop a comprehensive threat assessment. By combining these distinct intelligence streams, analysts can overcome the inherent limitations of any single collection method while leveraging the unique strengths of each approach. The addition of contract price data offers several distinct advantages that enhance the quality of these intelligence assessments.

Data from event contracts complements traditional all-source analysis in three primary ways. First, it provides quantitative probability assessments derived from aggregated expert knowledge that often includes perspectives not captured by conventional intelligence collection. For example, when a contract’s price rises from $0.15 to $0.68 over three weeks, this represents a measurable change in the collective risk assessment that can be evaluated against other intelligence indicators.

Second, prediction markets demonstrate exceptional speed in information integration, complementing the longer processing cycles typically associated with traditional intelligence collection. While HUMINT verification may require weeks and SIGINT analysis demands extensive processing, prediction markets provide near-instantaneous probability assessments as new information becomes available. This rapid response helps identify emerging threats that might warrant increased collection through traditional channels.

Third, event contract data serves as a correlation measure within the all-source framework. Alignment between market pricing data and traditional intelligence indicators strengthens analytical confidence. Divergence can highlight gaps requiring additional investigation.

The effective integration of contract data from prediction markets enhances all-source analysis through:

- Independent Validation. Market-based probability assessments provide verification mechanisms for hypotheses developed through traditional analysis. These assessments are particularly valuable in complex scenarios where conventional intelligence collection is limited.

- Collection Gap Identification. Significant movements in contract prices can highlight areas where traditional collection efforts might be insufficient. This suggests specific directions where more focused allocation of intelligence resources is needed.

- Analytical Timeline Compression. The rapid price discovery mechanism of prediction markets provides early warning indicators that complement longer-cycle collection methods, allowing earlier threat identification and response planning.

When properly integrated into all-source analysis, prediction market data provides quantifiable probability assessments while capturing diverse perspectives that might be inaccessible through traditional collection methods. This complementary relationship enhances both the scope and depth of a threat assessment while offering valuable cross-validation mechanisms for conventional intelligence sources.

Conclusion and Discussion

Prediction markets represent a useful, yet underutilized, dataset for enhancing national security intelligence collection and analysis. Platforms like Polymarket and Kalshi offer unique advantages through their ability to aggregate diverse perspectives, provide real-time probability assessments, and capture the collective judgment or wisdom of informed participants. The data generated by these markets—including price movements, trading volumes, and temporal patterns—can serve as leading indicators for emerging threats and validate insights from traditional intelligence sources.

Integrating prediction market data with established intelligence approaches (i.e., HUMINT, SIGINT, OSINT, GEOINT, and MASINT) creates a more robust framework for analysis. This synthesis allows intelligence analysts to develop more comprehensive threat assessments by combining quantitative, probability-based insights from prediction markets with qualitative intelligence gathered through traditional channels. The dynamic nature of these markets, which react instantly to new information, complements the often slower-moving traditional intelligence gathering processes.

Future developments could significantly enhance the utility of prediction markets for national security. Advances in artificial intelligence and machine learning could enable more sophisticated analysis of prediction market data, identifying complex patterns and correlations that human analysts overlook. Artificial intelligence systems could monitor hundreds of related contracts simultaneously, flagging anomalous trading patterns that might indicate emerging threats before they become apparent through other channels.13

As prediction markets mature, specialized contracts focused on national security concerns could provide more granular and relevant data. These markets could be designed to capture insights into specific regions, types of threats, or categories of security concerns, while implementing appropriate safeguards against manipulation and adversarial exploitation. The integration of blockchain technology could also enhance the transparency and reliability of prediction market data while maintaining necessary security protocols. Smart contracts could automate the verification of events and outcomes. This would reduce the potential for manipulation while increasing data reliability.

The future might also see the emergence of hybrid systems that combine prediction markets with other crowdsourced data, creating more comprehensive early warning systems for national security threats. These systems could potentially leverage both public markets and specialized, secure platforms accessible only to intelligence professionals.

The potential benefits of incorporating prediction market data into national security analysis are compelling. As these markets continue to evolve, they are likely to become increasingly valuable to the intelligence community, allowing it to more fully anticipate emerging national threats. The future of national security intelligence might well depend on our ability to effectively harness these new sources of collective intelligence, combining them with traditional methods to create more accurate, timely, and actionable threat assessments.

Endnotes

1. Adam Borison and Gregory Hamm, “Prediction Markets: A New Tool for Strategic Decision Making,” California Management Review 52, no. 4 (2010): 125-141, https://doi.org/10.1525/cmr.2010.52.4.125.

2. For further information on these platforms, see ”What is Polymarket?” User Guide-Get Started, Polymarket, https://learn.polymarket.com/docs/guides/get-started/what-is-polymarket/; and “About Kalshi,” Kalshi, 2025, https://kalshi.com/about.

3. Alasdair Brown, J. James Reade, and Leighton Vaughan Williams, “When are Prediction Market Prices Most Informative?” International Journal of Forecasting 35, no. 1 (2019): 420-428, http://doi.org/10.1016/j.ijforecast.2018.05.005.

4. James Surowiecki, The Wisdom of Crowds: Why the Many Are Smarter than the Few and How Collective Wisdom Shapes Business, Economies, Societies, and Nations (Doubleday Publishers, 2004).

5. For further information on the price discovery process, see Vernon L. Smith, Gerry L. Suchanek, and Arlington W. Williams, “Bubbles, Crashes, and Endogenous Expectations in Experimental Spot Asset Markets,” Econometrica 56, no. 5 (1988): 1119-1151, https://doi.org/10.2307/1911361.

6. Benjamin Lester, Andrew Postlewaite, and Randall Wright, “Information and Liquidity,” Supplement, Journal of Money, Credit and Banking 43, no. 7 (2011): 355-377, https://doi.org/10.1111/j.1538-4616.2011.00440.x.

7. Eugene F. Fama, “Efficient Capital Markets: A Review of Theory and Empirical Work,” The Journal of Finance 25, no. 2 (1970): 383-41, https://doi.org/10.2307/2325486.

8. The range of subjects available in event contracts is extensive. Polymarket, for instance, offers contracts in sports, politics, business, economics, geopolitics, pop culture, crypto, etc. Although not all contracts are immediately relevant as intelligence sources, their price behavior can provide context or further confirmation of an analyst’s assessment.

9. This raises the intriguing possibility of analysts fostering the creation of a new contract for a specific geo-political event to collect data anonymously from interested or informed individuals.

10. Ho Cheung Brian Lee, Jan Stallaert, and Ming Fan, “Anomalies in Probability Estimates for Event Forecasting on Prediction Markets,” Production and Operations Management 29, no. 9 (2020): 2077-2095, https://doi.org/10.1111/poms.13175.

11. Mayur Wankhade, Annavarapu Chandra Sekhara Rao, and Chaitanya Kulkarni, “A Survey on Sentiment Analysis Methods, Applications, and Challenges,” Artificial Intelligence Review 55 (2022): 5731–5780, https://doi.org/10.1007/s10462-022-10144-1.

12. Borison and Hamm, “Prediction Markets.”

13. Ryan H. Murphy, “Prediction Markets as Meta‐Episteme: Artificial Intelligence, Forecasting Tournaments, Prediction Markets, and Economic Growth,” The American Journal of Economics and Sociology 83, no. 2 (2023): 383-392, https://doi.org/10.1111/ajes.12546.

CDR Stephen Ferris (retired) is a professor of finance at the University of North Texas. He holds a bachelor of arts from Duquesne University, a master of business administration and a doctorate from the University of Pittsburgh, and a master’s degree in strategic studies from the U.S. Army War College. He also holds diplomas from the U.S. Army’s Command and General Staff College and the U.S. Navy’s College of Naval Command and Staff. His last active-duty assignment was with the J-4 on the Joint Staff.

CPT Raymond Ferris is the counterintelligence operations officer for 2nd Military Intelligence (MI) Battalion, 66th MI Brigade (Theater). He previously served as assistant S-2 for the 1st Armored Division, Division Artillery and as the company executive officer for Bravo Company, 532nd MI Battalion, 501st MI Brigade (Theater).